-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

- Financial Institutions

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

05 July 2023

FMA makes permanent stop order against Validus after appeal is dismissed in the High Court

Media Release

MR No. 2023 – 28

The Financial Markets Authority (FMA) – Te Mana Tātai Hokohoko – has made a permanent stop order (Order) that applies to Validus International LLC (Validus), Validus-FZCO, and associated persons of Validus, using the FMA’s powers under the Financial Markets Conduct Act 2013 (the Act).

The Order follows an interim stop order the FMA issued to Validus and associated persons in February 2023. The Order prohibits Validus and Validus-FZCO and associated persons from taking steps that will result in repeat unlawful behaviour that may cause material financial harm, in particular:

-

making offers of Validus Financial Products; and

-

distributing any restricted communication that relates to the offer of Validus Financial Products; and

-

accepting further applications, contributions, investments, or deposits in respect of Validus Financial Products.

The FMA notes that associated persons means anyone promoting Validus Financial Products in New Zealand*.

The term Validus Financial Products refers to the Validus Pool Products promoted at an event at Mt Smart Stadium on 19 November 2022 (Seminar) and to any other financial products used to promote the purchase of Validus educational packages, regardless of whether those financial products actually exist or are intended to be issued.

This is because following the FMA’s interim stop order, Validus wrote to the FMA (the “Validus Letter” referred to in the Order) to say the Validus Pool promoted at the Seminar had been removed and no longer exists. Further, the letter said “Validus is not, and does not intend to be, a financial product and no person should ever enter into a commercial relationship with Validus intending or expecting to make returns of any sort, as no such returns are promised or guaranteed in any way”.

The FMA’s stop order is based on the FMA accepting these statements are true. Therefore, what was said and presented at the Seminar was false or misleading, or was likely to mislead or confuse, because it related to an offer of financial products which did not exist or was materially different from that described.

Paul Gregory, Executive Director of Response and Enforcement, said:

“Seminar attendees were induced to purchase, purchased or intend to purchase, educational packages in reliance on false or misleading representations. They will not receive the promoted 2-3% return on their money, or be able to withdraw that money. They are likely to suffer material financial harm.”

Dr Parwiz Daud, Chief Network Officer of Validus, attended and spoke at the Seminar, during which a key speaker, Souai Tito, advised attendees that:

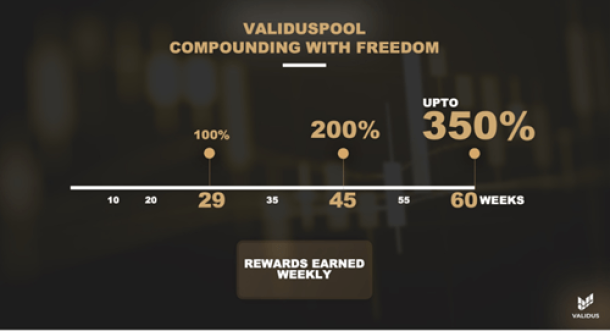

“… once you purchase a [education] pack you get rewarded … so with the money that you purchased your education packs, we have a team of experts that trade your money in the forex market. And with that you get paid 2 to 3% weekly loyalty points over 60 weeks.”

"We trade in stocks, and gaming, crypto, NFTs, staking...”

“… after 60 weeks you get 350% [of your money] back”.

Examples of the materials distributed at the Seminar are included within the Stop Order, and are a “restricted communication”, referred to in the Stop Order, relating to an offer, or intended offer, of financial products (namely, Validus Pool Products).

Mr Gregory said: “Validus has made false or misleading representations to the public that had every appearance of an unregulated offer of financial products. The FMA considers a stop order is the most appropriate and effective response in the circumstances. We urge the public, and the communities that Validus has been targeting, to stay away from this company and these offers. There are plenty of well-regulated products available to the public where such investments have protections, and monitoring in place from the FMA.”

This Order is in force from the time at which it was made, 2 May 2023, until such time (if any) as the FMA varies, suspends or revokes this Order.

Validus appeal dismissed in the High Court

Validus appealed the Order and applied for interim relief prohibiting the publication of the Order while the appeal was determined. The FMA agreed, without the need for an order from the court, to not publish the Order. The non-publication did not otherwise affect the status of the Order which remained in force during that time.

The appeal was heard on 21 June 2023 at the Auckland High Court. The court has now issued its decision and has not allowed the appeal. The Order remains in force and can now be published.

The Validus appeal was based on three points:

-

Validus’s right to be heard/natural justice

-

That the Order must apply to a financial product that exists/a financial product must exist for Validus to be making false or misleading offers

-

To issue a stop order, the FMA must be satisfied that Validus would break the law in the future if the Order was not in place and there was no evidence of that.

The Judge dismissed all three points.

In respect of the first point, Justice Jagose agreed that Validus was given enough opportunity to be heard “without any error of law on the part of the FMA”.

In respect of point two, the Judge agreed the reference to “intended offers” can be construed to extend to financial products not yet in existence. There is nothing in the statutory language to suggest the financial products must be in existence at the time of the offer or intended offer.

He said “the construction contended by Validus would be to exclude outright scams - inviting participation in non-existent financial products - from the FMA’s enforcement function. Nothing in the statutory purposes justifies such exclusion.”

On the third point, the Judge said because Validus acknowledged past breaches of the law, the FMA was within its right to issue the stop order based on the reasons set out in Section 462 of the Act. Section 462(2) of the Act provides at least three reasons for stop orders: past contravention, likely future contravention or “imminent danger of substantial damage” by any contravention. The judge agreed that the FMA may rely on any reasons independently to support the exercise of power to issue a stop order.

The FMA continues to cooperate with the Commerce Commission on matters relating to Validus.

ENDS

Notes

*Promotion in this context is not a defined term, instead this is intended as a general description of the behaviour.

The FMA made the order under sections 462, 463 and 466 of the Financial Markets Conduct Act.

For the purposes of the Order:

- associated person has the meaning given to that term in section 12(1) of the Act

- distribute, offeror and person have the meanings given to those terms in section 6(1) of the Act

- financial product has the meaning given to that term in section 7 of the Act

- restricted communication has the meaning given to that term in section 464 of the Act

- Validus International LLC is a Delaware-registered company

- Validus-FZCO is duly formed as a Free Zone Company with limited liability pursuant to Law no. 16 of 2021 by H.H. Ruler of Dubai and Implementing Regulations issued thereunder by the Dubai Integrated Economic Zones Authority.

See screen shots forming part of the restricted communication distributed by Validus at Mount Smart Stadium, November 2022, now prohibited: